● LIVE

VISION AI

coming soon

VISION AI

VISION AI

coming soon

How it Works

Three AI models working together to deliver accurate, defensible valuations — instantly. Select a module below:

MODULE 1

REBUILD

MODULE 2

REPLACE

MODULE 3

REVALUE

● LIVE

VISION AI

coming soon

VISION AI

VISION AI

coming soon

MODULE 1

REBUILD

Visual Intelligence for Property Reinstatement

The Challenge: UK property under-insurance is at an all-time high due to skyrocketing construction costs and inaccurate desktop valuations.

The Solution:

REBUILD enables policyholders to create a "Forensic Digital Twin" of their home. This provides underwriters with the exact data needed to set accurate premiums without the need for physical site visits.

No commitment. See why modern insurers are switching to Vision AI.

module 2

REPLACE

The Next Generation of Home Contents Risk Management

The Challenge: Traditional contents underwriting is "blind," relying on policyholder estimates that lead to friction during claims and vulnerability to fraudulent inflation.

The Solution: REPLACE digitises the home inventory process, providing a verified, image-backed baseline for Visual Underwriting.

No commitment. See why modern insurers are switching to Vision AI.

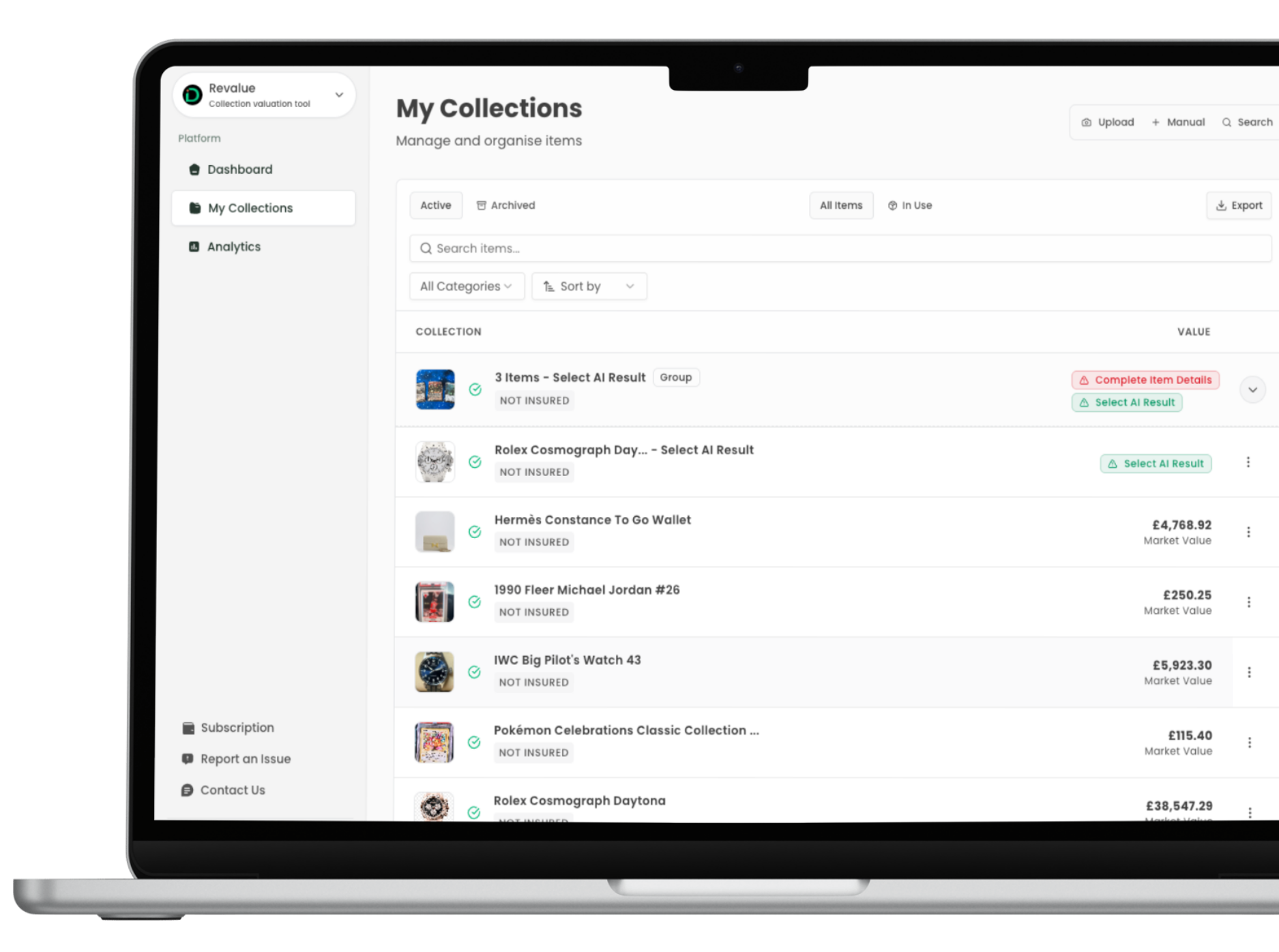

MODULE 3

REVALUE

Enterprise Intelligence for High-Value Collectibles

The Challenge: Assets like watches, jewellery, and fine art are highly volatile. Static valuations become obsolete quickly, creating significant risk for speciality insurers.

The Solution: REVALUE provides a live, forensic-grade valuation engine that monitors the global market to ensure luxury assets are never under-insured.

No commitment. See why modern insurers are switching to Vision AI.

GET STARTED TODAY

The Future of Underwriting is

Visual.

Leading insurers don't guess—they verify. Vision AI provides the eyes you need to eradicate under-insurance, stop fraud at the source, and charge the correct premium for every risk.

No commitment. See why modern insurers are switching to Vision AI.