STOP GUESSING RISK. START SEEING IT.

Visual Intelligence for Modern Insurers

The Future of Underwriting is Visual. Leading insurers don’t guess—they verify.

Our Vision AI models—Rebuild, Replace, and Revalue—empower your customers to provide real-time, AI-verified asset data for instant, accurate decisioning. Eliminate under-insurance, charge the correct premiums, and stop fraud at the source with our advanced FNOL AI module.

No commitment. See why modern insurers are switching to Vision AI.

Our Products

AI-Powered valuation modules for

Insurance Customers

Explore our suite of AI-powered modules to help insurance customers avoid under-insurance, never be left out of pocket or felt let down.

Rebuild

Replace

Revalue

in minutes.

Three AI models working together to deliver accurate, defensible valuations — instantly.

Rebuild

Replace

Revalue

in minutes.

Three AI models working together to deliver accurate, defensible valuations — instantly.

● LIVE

VISION AI

coming soon

VISION AI

VISION AI

coming soon

INTRODUCING

Accurate rebuild, contents, and collection valuations.

REBUILD

Buildings Replacement

Precision Property Intelligence for Accurate Indemnity

REBUILD leverages advanced

Visual Intelligence to eliminate the "valuation gap" that plagues property portfolios. By transforming policyholder-captured photos into forensic-grade structural data, REBUILD automates material evaluation and cost estimation. This enables a seamless

Visual Underwriting workflow, ensuring that every property is insured for its true reinstatement value from the outset.

No commitment. See why modern insurers are switching to Vision AI.

REPLACE

CONTENTS Replacement

The Next Generation of Contents Risk Management

REPLACE utilises Visual Intelligence to digitise the contents inventory process. Policyholders use the Vision AI mobile app to document assets in seconds, creating a verified digital ledger of replacement values. This real-time visibility allows for sophisticated Visual Underwriting of high-volume contents portfolios, eliminating disputes and fraudulent inflation at the point of claim.

No commitment. See why modern insurers are switching to Vision AI.

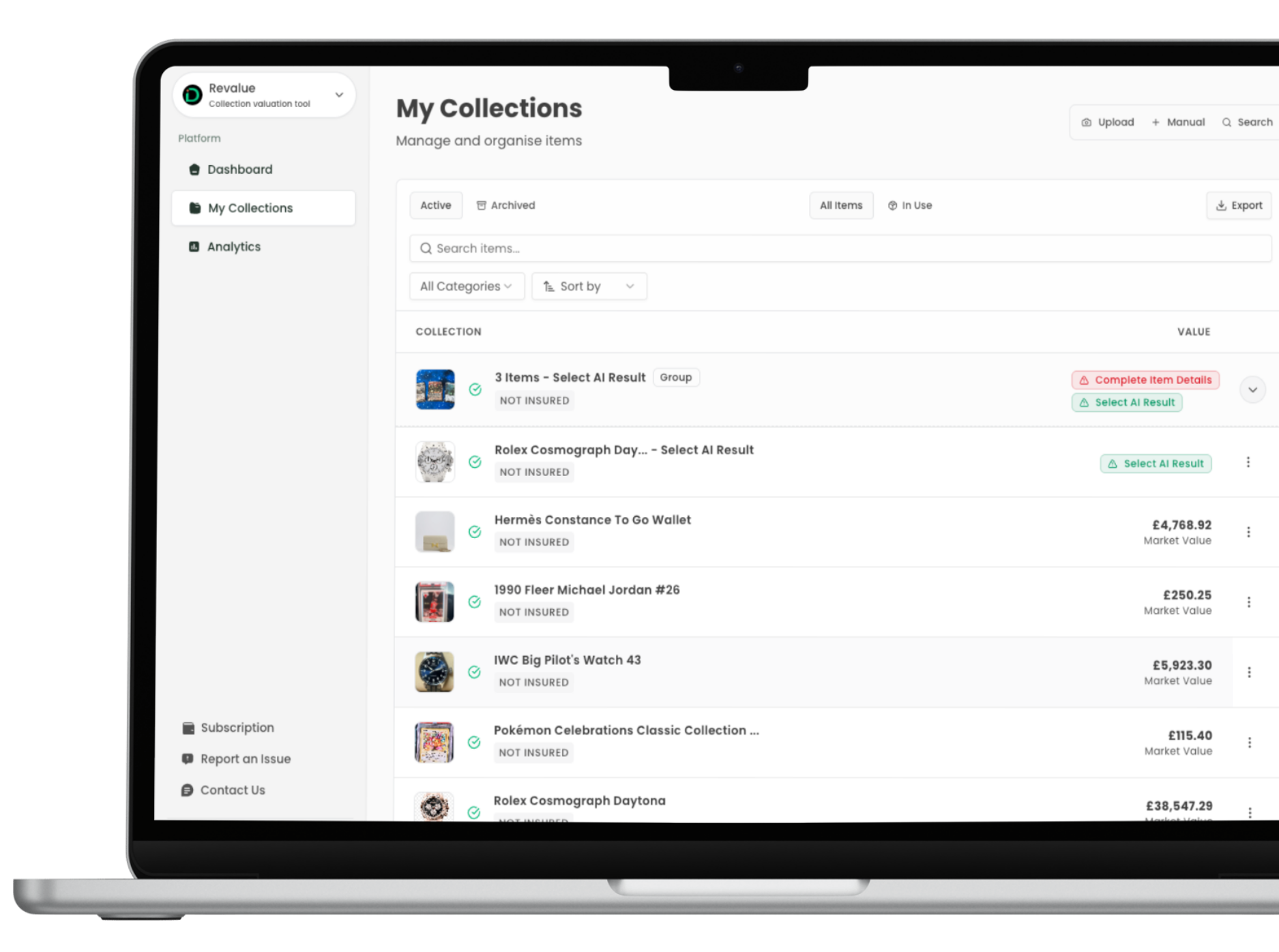

REVALUE

COLLECTION VALUATION

Enterprise Intelligence for High-Value Collectibles

REVALUE is an enterprise-grade engine designed for the complexities of luxury asset valuation. By applying

Visual Intelligence to high-resolution smartphone imagery, the module analyses millions of global data points in real-time. This provides the forensic accuracy required for the

Visual Underwriting of art, watches, and luxury collectibles in volatile global markets.

No commitment. See why modern insurers are switching to Vision AI.

ANALYTICS & INSIGHTS

Powerful AI

Analytics

Track and analyse your AI operations with real-time insights across geographic reach, processing patterns, and performance metrics.

Global Reach

Discover where your users are coming from. Identify geographic reach, analyse regional performance, and optimise for global markets.

Platform Intelligence

Monitor platform usage patterns and optimise AI delivery. Track device types, integration methods, and API consumption across platforms.

Device Analytics

Understand device distribution and optimise for each platform. See from which devices users access and process data through your AI systems.

GET STARTED TODAY

The Future of Underwriting is

Visual.

Leading insurers don't guess—they verify. Vision AI provides the eyes you need to eradicate under-insurance, stop fraud at the source, and charge the correct premium for every risk.

No commitment. See why modern insurers are switching to Vision AI.